The PTB-PVDA wants a Corona Tax on big fortunes

The PTB-PVDA proposes the introduction of an exceptional Corona Tax on fortunes exceeding 3 million euros in order to guarantee the income of families during the coronavirus crisis. "The coronavirus crisis is first and foremost a health crisis. At the same time, there is a social emergency, with a million people threatened with technical unemployment. It is important today that measures be taken to protect workers' salaries," explains Raoul Hedebouw, spokesperson for the PTB-PVDA.

"In times of crisis, the wealth redistribution issues are far more forceful. On the one hand, hundreds of thousands of families now see their incomes threatened. On the other hand, vast amounts of money are amassed by a handful of multimillionaires. With this small "one shot" tax of 5 % on the few wealthiest families in the country, we can raise at least 15 billion. This money will make it possible to increase the compensation for economic unemployment and to guarantee the incomes of all workers currently affected by the crisis in our country."

"There's an urgent need to protect workers' incomes."

Estimates suggest that at least one million workers are in economic unemployment. According to the government's proposal, they will be paid no more than 70 % of their salary. And then again, with a maximum ceiling (€ 2,750 gross plus a premium of € 5 gross per day) which means that an average worker will lose up to € 500 per month. Not to mention the fact that a number of sectors and services are not even entitled to it.

"I've received hundreds and hundreds of testimonies from worried people who don't know how they're going to manage at the end of the month", says Raoul Hedebouw. "The government has promised a lot for big business, but it is time for an emergency response that is up to the task for workers. Economic unemployment must be extended to all workers: to employees, student-jobbers, all temporary workers, etc. so that no worker is left behind. And we have to guarantee them 100 % of their wages during the crisis while increasing the current ceiling to the average wage (€ 3,558 gross)."

"A small one-shot tax that would only affect multimillionaires"

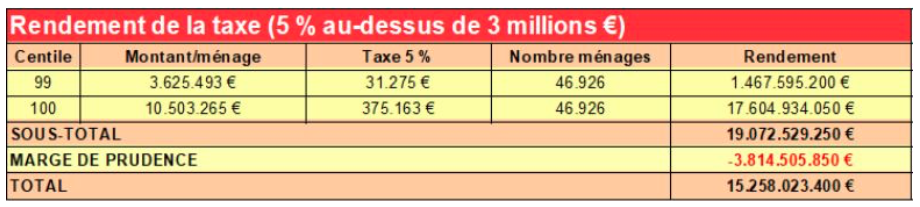

According to the calculations of PTB-PVDA tax expert Marco Van Hees, an exceptional tax of 5 % on multimillionaires could yield up to € 15 billion (see calculation below). This would affect only 2 % of the population, but it would make it possible to create a fund to refinance social security and absorb the cost of increased economic unemployment.

"A small section of the population has become much richer in recent years thanks to the effort of millions of workers. Barely 2 % of the population owns assets of € 663 billion. Nothing is more normal than to ask them today in times of crisis for a small solidarity contribution", concludes Raoul Hedebouw.

CORONA TAX

1. terms and conditions of the tax

The Corona Solidarity Tax is an exceptional or "one-shot" tax, which means that it is levied only once. A single levy justifies a higher rate than an annual tax. The rate of the tax is thus set at 5 %. It would apply to household assets from € 3 million upwards. For example, a household with assets of € 4 million would pay a tax of € 50 000 (€ 1 million x 5%).

The assets taken into account are the total assets of the household, i.e. the sum of real estate, financial assets and valuable movable property (yacht, jewellery, master paintings, etc.) from which debts are deducted. The tax shall be calculated on the amount of such assets exceeding € 3 million.

2. tax yield

The Corona Solidarity Tax can bring in 15 billion euros.

This return is estimated by applying the breakdown of assets calculated by Professors Rademaekers and Vuchelen (VUB) (1) to the current total assets of Belgian households..

|

Step 1 - Calculation of total household assets: real estate assets € 1,412,000 million (2) financial assets € 1,390,389 million (3) - debts € 300,476 million (4) € = 2,501,913 million . Movable property is not included here because its share in the total is negligible (around 2 %). Step 2 - Breakdown of Assets : The percentiles of interest to us are the 99 and 100 percentiles, which represent the 2 %richest percentiles of the population. Households in the 99 percentile own 6.8 %of total wealth, or 170.13 billion euros. Households in the 100 percentile own 19.7 %of total wealth, or 492.88 billion euros. Step 3 - Calculating the tax : To estimate the yield from the tax, the wealth of a percentile is divided by the number of households that make up the percentile (46,926). This gives the average wealth per household. A tax of 5 %is then applied to this amount (above 3 million euros). The tax amount per household is then re-multiplied by the number of households to get the total percentile return. This process is applied at the 99 and 100 percentiles (see table). A margin of caution of 20 %is subtracted from the result to take into account possible statistical inaccuracies and a proportion of fraud. This gives a return of 15 billion euros.. |

(1) Rademaekers &Vuchelen, "De verdeling van het belgish gezinvermogen", Cahiers Economiques de Bruxelles, No. 164, 4th quarter. 1999, p. 425

(2) 2018 estimate by the National Accounts Institute, quoted by La Libre Belgique, 20 March 2018.

(3) National Bank of Belgium, 2019 Report, Statistical Annex, p. 27 - Outstanding amounts at 30 September 2019.

(4) Ibid.